Dugas

Law Firm

Serving Michigan families from our offices located in Livingston County, Brighton, Michigan.

Our firm is a comprehensive Estate Planning & Probate Law Firm

Contact our Offices at

(810) 227-2702

Law Offices of

Dugas & Associates

Suzanne M. Dugas, J.D., LLM.

810 W. Grand River

Brighton, Michigan 48116

Call us at:

(810) 227-2702

Michigan Estate Planning & Probate Firm

Estate Planning - It's not rocket science. Submitted by Suzanne M.Dugas, J.D., LLM

copyright 2011

The process of estate planning is to anticipate and facilitate the distribution of an estate. A comprehensive estate plan plan will eliminate uncertainties over the administration of a probate and maximize the value of the estate by reducing taxes and other administrative expenses. An estate plan also enables families to designate a guardian for their minor children as well as themselves should there be a period of incapacitation.

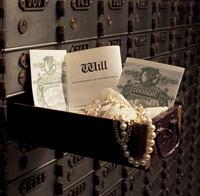

Estate planning involves several different documents including a will, trusts, powers of appointment, property ownership (joint with rights of survivorship, tenancy in common, tenancy by entirety), gifts, and power of attorney including durable financial power of attorney and the durable medical power of attorney. A well prepared estate plan also enables parties to specify whether to be buried or cremated, gifts of specific personal property including heirlooms, antiques, collections, etc., and other areas of concern such as pet issue.

$13,000.00 Gift Tax Exemption - Moving assets from the estate?

This is a one size fits all tax exemption. Every person can take advantage of the $13,000.00 gift tax exclusion and can make as many gifts throughout a year, to as many persons as they wish, as long as no one person receives more than $13,000.00 in any one year.

Married couples can gift a total of $26,000.00 a year to any individual in any one year. The individual receiving the gift can be a relative or not. The gift can be in cash or non-cash such as stocks, real property, an interest in your favorite Van Gough painting or your summer beach house.

Articles

Passing from generation to generation - Family Limited Partnership

An individual can reduce estate tax liability through gifts of cash and assets, but this can be a double edge sword. Certainly one edge is a larger estate to one's heirs, yet with it brings the other edge of the sword...loss of control over asset. This conversation has been had with the majority of our clients at the Dugas Law firm. The questions that always follows: " How can I maintain control and reduce my estate liability?"

The answer for some individuals may be a Family Limited Partnership. The older generation is able to maximize their gifts during their lifetime and maintain control of the asset simultaneously. The older generation can shift appreciation and possible income, to a lower tax bracket generation or generations.

4. > Joint Ownership

Joint Ownership - At what Cost?

There are many legal forms of ownership of property including, tenants by the entirety, joint with rights of survivorship and tenants in common. This status can apply to both real estate and personal property such as a bank account, portfolio account, CD's and other property. As our office has advised over the years it is always best practices to maintain absolute control over your assets during your lifetime. This can easily be changed by placing other names on ownership of your assets.

It is the belief of many persons that the best way to pass your estate is by putting your family on your property both personal and real, and it will then pass by operation of law at your death. The latter may be true but at what cost?

If you are married, ownership, in Michigan is tenants by the entirety. It is the instance, in many cases, that a spouse will pass away and the title will be changed placing the children on the deedd as joint tenants with rights of survivorship. There are several costs to this move.

5. > Pet Trust

Pet Trust - Who loves you baby!

Under Michigan Statute MCL 700.2722, a pet trust is a legally enforceable agreement. The traditional pet trust can provide the owner with the ability to control the pet's care and the trust assets through appointment of a trustee, caregiver, adn trust protector of your pet. The trust can specify the type of care your pet will receive, alternate appointments should either trustee or caregiver no longer be able to accept or maintain their position, arrangements after the death of your pet, and future beneficiaries of the estate.

This pet trust assures the pet owner that their wishes for the care of their animals will be carried out. A pet trust can provide detailed instructions, management of funds, and continued care through a pet guardian upon a disability of the owner.

Social Security - To take or not to take!

Trying to understand when the best time is to take your social security is rocket science. It is important to understand the nuances of this for it could mean thousands of dollars to the average couple. Tapping social security benefits to early, for many baby boomers this is age 62, may not be the best approach if it is not necessary.

Many boomers are taking early. In 2009, 42% of 62 year olds claimed benefits, up from 38% in 2007, according to economist at the Brookings Institution in Washington D.C. If one delays taking at the earliest retirement age of 62 they can boost their payments by 7 - 8% a year if delaying until the age of 70.

6. > Social Security